The semiconductor industry is an important foundational industry in the development of all industries in the world. Semiconductor products cover many electronic industries. For semiconductors, the changes in market prices will have a great impact on the entire industrial chain. In 2018, with the rise of new energy vehicles, the scale of precision resistors, capacitors, high precision shunts and other products in the semiconductor industry has expanded rapidly, and won many market pioneers. Many resistor manufacturers also reached a certain peak in sales.

At present, most market regulators believe that the global semiconductor boom in 2019 will be low growth, but also expected to negative growth. For example, the foreign capital, Morgan Stanley, pointed out that the semiconductor industry actually increased its production by 22% in 2018, but the market only absorbed 15% of the increase. At present, there is still 7% excess capacity to be absorbed. This makes inventory digestion a big challenge in 2019. Therefore, it is expected that the global semiconductor industry will not see the bottom of the cyclical downturn. It also revised the growth rate of industrial output in 2019, from negative growth of 1 percent to negative growth of 5 percent.

Memory is the key to the main reason that the semiconductor industry will enter an oversupply in 2018. Because of the continuous expansion of production before, the oversupply of memory led to a decline in storage prices, coupled with weak demand for PC, servers and smartphones and other terminal products, which slowed down the growth of revenue from major memory suppliers. As a result, the recent pace of manufacturers to slow the pace of new capacity to slow the price decline. Global sales of semiconductor manufacturing equipment in 2019 are expected to decline for the first time in four years.

Memory is the key to the main reason that the semiconductor industry will enter an oversupply in 2018. Because of the continuous expansion of production before, the oversupply of memory led to a decline in storage prices, coupled with weak demand for PC, servers and smartphones and other terminal products, which slowed down the growth of revenue from major memory suppliers. As a result, the recent pace of manufacturers to slow the pace of new capacity to slow the price decline. Global sales of semiconductor manufacturing equipment in 2019 are expected to decline for the first time in four years.

Another reason for the decline in global semiconductor sales in 2019 is a drop in demand for smartphones, which has led manufacturers to reduce investment. The semiconductor boom cycle from 2009 to 2018, The popularity of smartphones, mainly due to technological advances, has led to a boom in mobile processors, memory, lenses and other industries. However, the current penetration of smartphones saturated, sales bottlenecks, the semiconductor industry has also contracted.

While global semiconductor sales are set to hit an all-time high of $62.1 billion in 2018, an increase of 9.7 percent from 2017, 2019 is set to fall to $59.6 billion for the first time in four years, or about 4 percent, according to figures. Even as global sales of semiconductors are expected to rebound to $71.9 billion by 2020. However, the industry prospects are not clear, the overall market situation is still not optimistic.

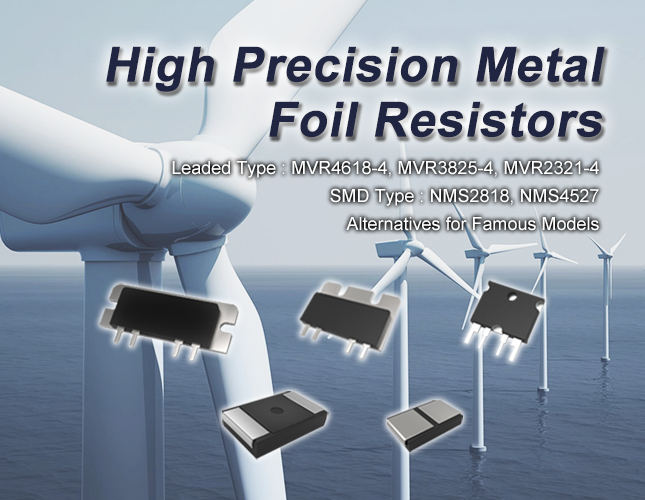

It is worth noting that the semiconductor industry is still developing strongly, and the demand for semiconductors is still very large in many rising products, such as the new energy industry vigorously developed in Europe, which absorbs a large number of wind power resistors, thin film resistors, MOS transistors and transistors. New energy sources in the European region will continue to expand in the future and demand for semiconductors will remain strong.

It is worth noting that the semiconductor industry is still developing strongly, and the demand for semiconductors is still very large in many rising products, such as the new energy industry vigorously developed in Europe, which absorbs a large number of wind power resistors, thin film resistors, MOS transistors and transistors. New energy sources in the European region will continue to expand in the future and demand for semiconductors will remain strong.