While China's major new energy vehicle (NEV) manufacturers, including the world's top seller BYD, saw strong sales growth in 2022, tough COVID curbs that disrupted supply chains and dented consumer confidence meant that some others players missed their annual targets.

The mixed picture comes as the industry prepares for slower growth as it enters its first year without generous government subsidies that have nurtured it into the world's largest NEV market, and helped its companies become globally competitive.

China's NEV shipments totaled 6.5 million units in 2022, up 96.3% from the previous year, according to data from the China Passenger Car Association (CPCA) released on Tuesday.

In 2022, NEVs accounted for 27.6% of all vehicles shipped to dealerships, nearly double the share in 2021, CPCA data showed.

The figure means the sector has already beaten an official target for NEV sales to make up one-fifth of overall vehicle sales by 2025, though it came on the back of a slump last year in growth of traditional auto sales.

Projections of NEV sales growth this year put the figure in the 30% to 40% range. An enviable rate for many industries, it would be a considerable slowdown from 2022. The CPCA forecast that China's NEV sales will rise 31% in 2023 to 8.5 million vehicles, accounting for 36% of all vehicle sales.

Last year's retail sales growth across the Chinese NEV market contrasted strongly with stagnant growth of overall auto sales, which were up just 1.9% in 2022 to 20.54 million units compared with 4.4% growth to 20.15 million units in 2021, according to CPCA data. NEV retail sales growth also slowed from 129.2% in January to 35.2% in December year on year according to the CPCA. Around 640,000 NEVs were sold in the final month of the year.

From the supply side, a shortage of critical components like chips also contributed to production slowdowns and decline for the first half of 2022 due to a chip shortage and COVID.

The CPCA held a positive attitude on the exit of the subsidy policy for NEVs in China, stating it can help companies focus more on the market if the subsidies' income did not match an ideal outcome. They added that it could also cool market expectations, leading to a lowering of prices for upstream raw materials like lithium used in most electric vehicle batteries.

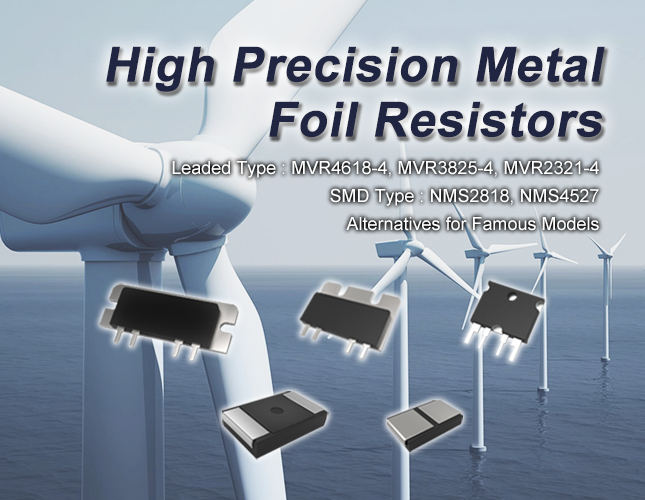

The forecast of EV Chips demand and full range of supply chain industries all alerted on building up stocks and production capacity to meet with the strong demand. Microhm Electronics Limited has also strengthen our production capacity in both China and SEA to with meet with forecast of Precision resistors like MVR series, shunts resistors for EV batteries systems and Chip resistors for EV central control systems for various production plants of our key customers.